Buying an overseas property can be daunting. Unlike some other places in the world, acquiring a UK property can be relative straightforward. UK has historically been a very open and accessible market for international investors. If you are toying with the idea of investing in UK, here is the step-by-step guide to start your international real estate journey.

Buying an overseas property can be daunting. Unlike some other places in the world, acquiring a UK property can be relative straightforward. UK has historically been a very open and accessible market for international investors. If you are toying with the idea of investing in UK, here is the step-by-step guide to start your international real estate journey.

1. Understand budget & finance

Getting your finances in place and knowing how much money you can borrow is vital before your search. Speak to your banker or mortgage brokers to get assessment on how much you can borrow. Remember you still need to set aside some savings to pay for Stamp Duty, Legal fees, Surveyor charges and Furnishings costs.

2. Search and identify what you want with help of B&R

Finding the right investment property in the UK is much like finding the right property anywhere in Singapore or around the globe.

Area – You need to identify which area to buy since London is a large city with 32 different boroughs.

Type & Bedrooms – Do you prefer a house or apartments? How many bedrooms and bathrooms do you want? You can choose from studio to penthouses and note that one/two bedroom is the most popular choice for investors. As a foreign investor, you are eligible to purchase all types of properties, whether under-construction, new or resale.

New vs Old – Do you want an older property or a brand new off plan property which completes in a later date?

We are an ideal partner for anyone looking to purchase a property in London. Our detailed local knowledge of all parts of London will soon help you find the location that is right for you. Once we know your requirements, finding the properties of your choice will be easy.

If you are unable to view the properties in London, we are able to provide photographs, video, or even a Zoom walkthrough.

3. Make an offer

Make an offer on the identified property. Once offer is accepted, proceed to reserve to take the unit off market. Note that there are no legal obligations until contracts are signed.

When your offer is accepted, Memorandum of Sales will be created and circulate to all parties including lawyers for both buyer and seller.

4. Conveyancing process

Using an efficient and experienced solicitor is the key for a quick and smooth purchase. You will need to instruct your solicitor with the conveyancing process.

Conveyancing is the term used in the UK for the process of the buyer’s solicitor and the seller’ solicitor agreeing on all the legal paperwork and for your solicitor to check everything for you which will include checking that the seller has the right to sell the property.

If you are buying the property with another person, whether a friend or family member, then there are two ways to own the property – either as.

‘Tenants in Common’ where each owns a set share- this can either be half each, or a defined percentage and when one dies itis passed as set in their will;

or

Joint Tenants, then if one partner dies, the other automatically becomes the sole owner of the home – this is generally what married couples do.

The completion date is then set by mutual agreement, but is usually one month after exchange. With off-plan properties, completion can be in several years’ time and there will usually be staged payments as stated above.

5. Completion & Handover

Completion is when the balance of the monies is transferred by your solicitor to the seller’s solicitor’s account.

Keys will be available to you once the funds have cleared in the seller’s account.

At the handover, the snag list should be checked that all issues are resolved.

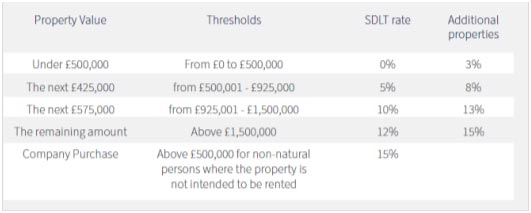

You are also require to pay stamp duty upon completion and a surcharge of 2% will be applied to non-UK residents.

All new homes in the UK are covered by a 10-year home warranty and insurance guarantee which is free to the purchaser. This provides comprehensive protection against a range of eventualities, including problems with the home’s construction.

If you are getting a completed property, you may consider getting a survey done to check and alert you on any potential problems.

Congratulations, you are now the legal owner of your new property!

6. Furnishing and finding a tenant

We offer a complete one-stop lettings service to source and find the best calibre tenants at the highest rent. For property management, we collect the rent and pay it into your account, deal with any maintenance issue and ensure the tenant looks after your property.

It is common to provide furnishings for your tenant should you decide to let it out. Find an experienced company who has experience in handling international clients to professionally designed and furnished apartments for rent.

7. Taxes

Landlords not resident in the UK must register with HMRC (UK Tax Authority), it is the Law in UK every investor must submit a tax return for their UK income, whether there is tax to pay or not.

Tax rules change regularly so it is vital to employ an expert to ensure you don’t pay tax unnecessarily.

Read more on Step to Step Guide in Buying UK Properties Guide

Start Your Property Search now

Contact of Singapore office

Buying an overseas property can be daunting. Unlike some other places in the world, acquiring a UK property can be relative straightforward. UK has historically been a very open and accessible market for international investors. If you are toying with the idea of investing in UK, here is the step-by-step guide to start your international real estate journey.

Buying an overseas property can be daunting. Unlike some other places in the world, acquiring a UK property can be relative straightforward. UK has historically been a very open and accessible market for international investors. If you are toying with the idea of investing in UK, here is the step-by-step guide to start your international real estate journey.